The cryptocurrency market has once again demonstrated its notorious volatility, with Bitcoin, the leading digital currency, experiencing a significant drop in its value.

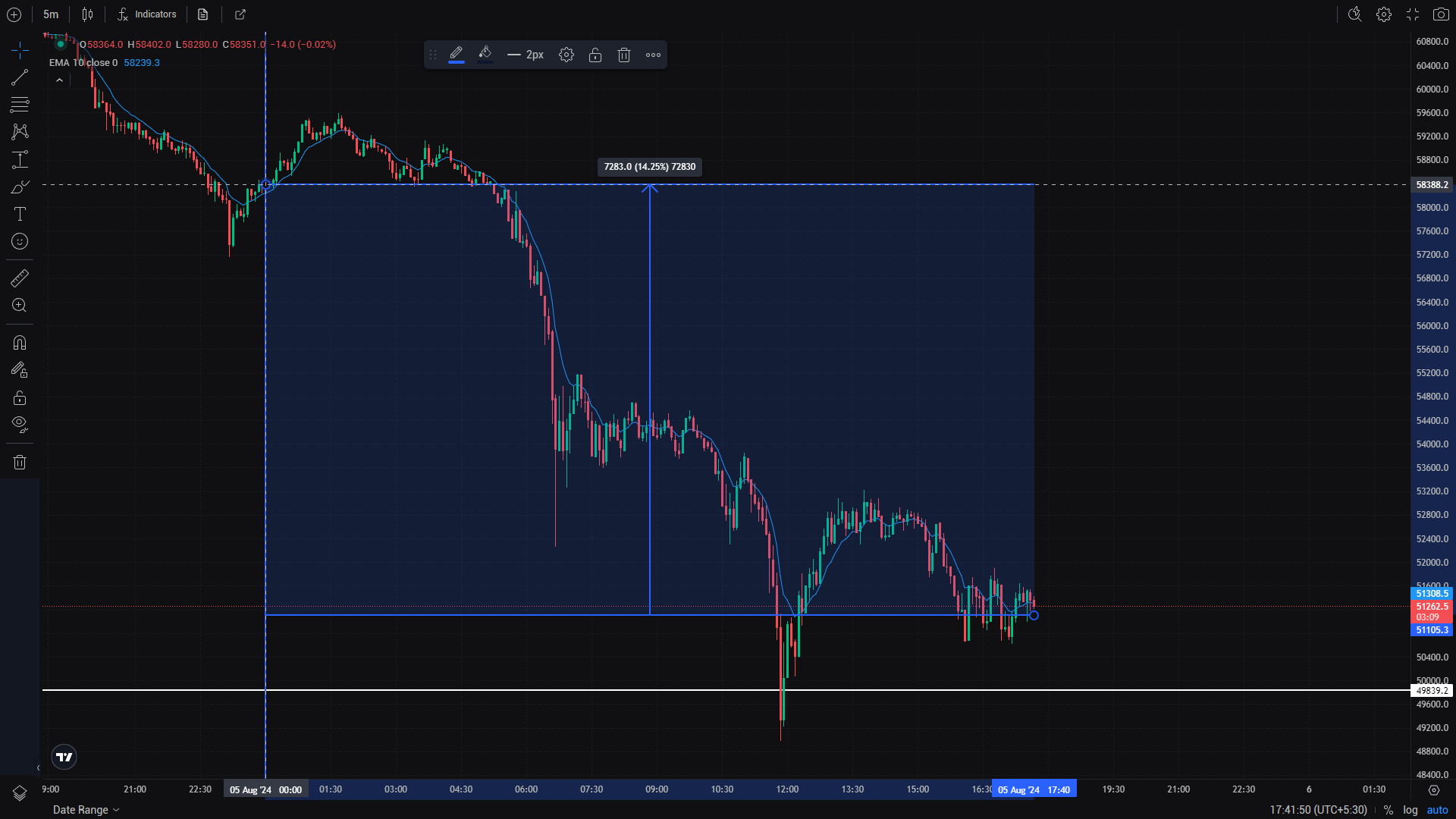

Over the past week, Bitcoin’s price plummeted by 14%, sending ripples of concern through the investment community. This article explores the potential reasons behind this decline, the reactions from the market, and what the future might hold for Bitcoin.

Bitcoin’s value is known for its sharp fluctuations, but a 14% drop in such a short period is noteworthy even for this volatile asset. The initial shock came as Bitcoin, which had been trading relatively steadily, suddenly lost a significant portion of its value. This sharp decline raised alarms among investors and analysts, prompting a closer examination of the factors at play.

Several factors can contribute to a sudden decrease in Bitcoin’s price. While it is challenging to pinpoint a single cause, a combination of the following factors likely played a role:

Regulatory developments often have a substantial impact on cryptocurrency prices. Recently, there have been increasing concerns about stricter regulations in major markets. For instance, the U.S. Securities and Exchange Commission (SEC) has been ramping up its scrutiny of cryptocurrency exchanges and initial coin offerings (ICOs). Any indication of tighter regulatory measures tends to create uncertainty and fear among investors, leading to sell-offs.

News and rumors, even if unsubstantiated, can trigger significant price movements. In recent weeks, there has been a general bearish sentiment in the market, influenced by various factors such as economic uncertainties and global financial instability. This negative sentiment can lead to panic selling, further driving down prices.

Sometimes, a price drop can be attributed to technical factors such as reaching a resistance level or breaking through a support level. In Bitcoin’s case, the recent decline might have been triggered by such technical factors, leading to a cascade of sell orders.

Broader economic conditions also influence the cryptocurrency market. Factors such as inflation, interest rates, and geopolitical tensions can impact investor behavior. For example, rising inflation or an increase in interest rates might prompt investors to move their funds from riskier assets like cryptocurrencies to safer investments like bonds or gold. Recent economic indicators suggest a tightening monetary policy, which could have contributed to the sell-off in Bitcoin.

The 14% drop in Bitcoin’s price has elicited a range of reactions from different market participants.

For investors and traders, such a significant drop can be a source of anxiety or opportunity. Long-term holders, often referred to as “HODLers,” might view this as a temporary setback, holding onto their investments with the belief that prices will eventually recover. On the other hand, short-term traders might take advantage of the volatility to execute trades, aiming to profit from the price swings.

Cryptocurrency exchanges are directly affected by price movements. A significant drop in Bitcoin’s price can lead to increased trading volumes as investors rush to buy or sell. This surge in activity can strain the infrastructure of exchanges, leading to potential technical issues such as slow transaction times or temporary outages.

Financial analysts and cryptocurrency experts have been offering their insights and predictions following the recent drop. Some believe that this correction was overdue, considering Bitcoin’s substantial gains over the past year. Others warn that further declines might be on the horizon if the underlying issues, such as regulatory uncertainties and economic conditions, are not addressed.

The future of Bitcoin, as always, remains uncertain. However, several scenarios could unfold in the wake of this recent decline:

Bitcoin has a history of bouncing back from significant drops. If the market sentiment improves and the regulatory environment becomes clearer, Bitcoin could recover its lost value and continue its upward trajectory. Institutional adoption, increased acceptance as a payment method, and advancements in blockchain technology could all contribute to future growth.

Given its inherent nature, Bitcoin is likely to continue experiencing high volatility. Investors should be prepared for further price swings, both upward and downward. Staying informed about market trends, regulatory developments, and macroeconomic factors will be crucial for navigating this volatility.

Some analysts suggest that the recent drop might be part of a broader market correction. After a prolonged period of substantial gains, a correction can help stabilize the market by shaking out speculative investments and resetting prices to more sustainable levels. This could ultimately create a healthier environment for long-term growth.